On several weekends, 21-year-old student Lavanya Jain accesses the BlaBlaCar app to secure a ride from Noida, located on the edges of New Delhi, to his residence in Kandhla, a quaint town in the northern part of India’s Uttar Pradesh region. The trip, covering 120 kilometers, costs him roughly ₹500, approximately $6. This is a mere fraction compared to the ₹1,500–₹2,000, or $17–$23, he would incur for a private taxi.

“If you’re seeking a quick, efficient, budget-friendly, and comfortable method to travel—and enjoy conversations—BlaBlaCar is definitely worth checking out,” Jain shared with TechCrunch, noting that he has utilized the app around 40 to 50 times in the last two years.

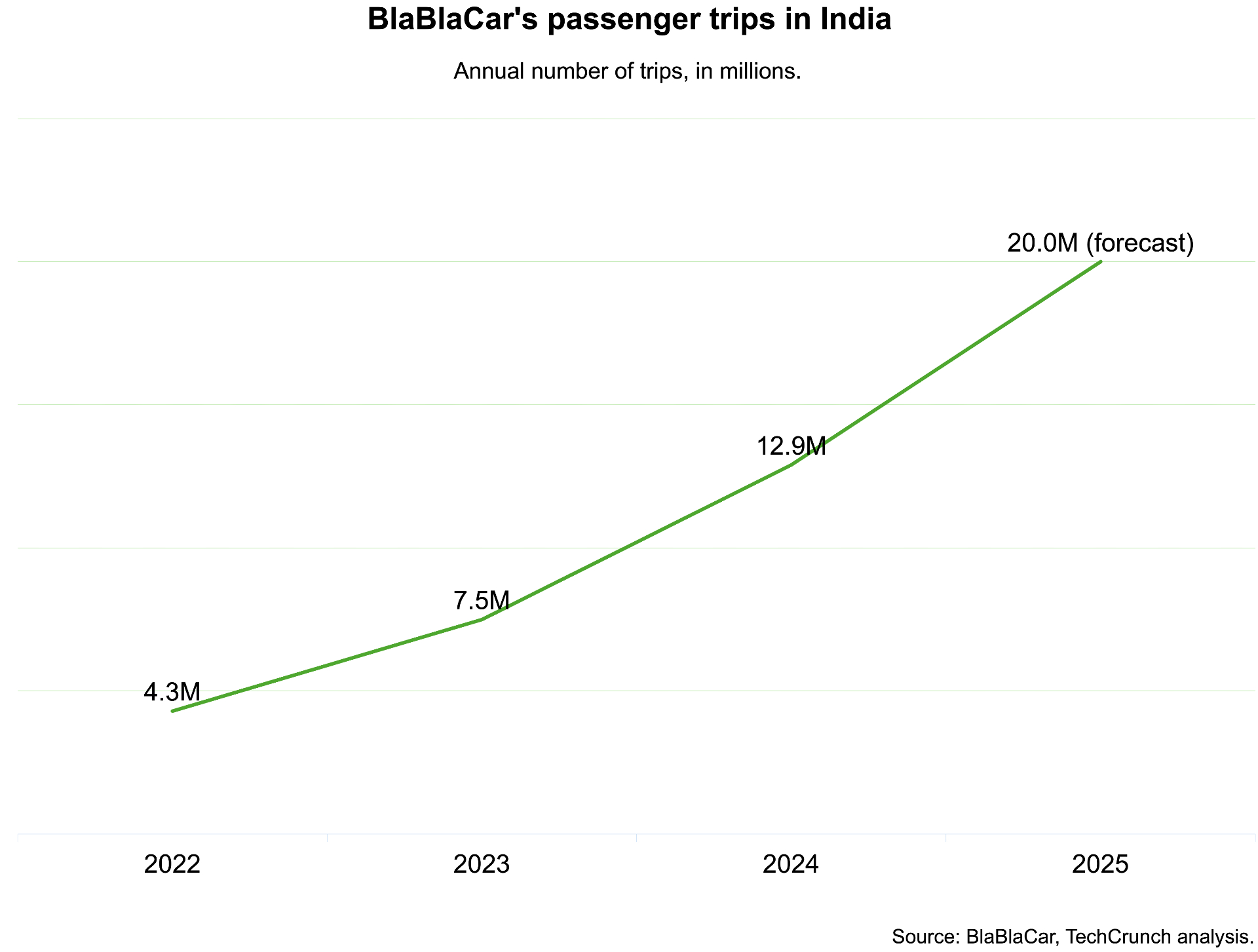

Jain is among millions of Indians who are opting for long-distance carpooling as a cost-effective and more social means to travel between cities. This trend has made India BlaBlaCar’s largest global market, estimating around 20 million riders this year—nearly a 50% increase from last year. According to this prediction, BlaBlaCar’s India market would exceed the 18 million riders anticipated in Brazil and its native market of France.

The turnaround is remarkable for a company that closed its India office in 2017 due to low demand.

The growth largely occurred without marketing efforts or a localized workforce, instead fueled by word-of-mouth referrals, increasing mobile internet accessibility, and the growing trend of digital payments and car ownership among India’s middle class.

India boasts over 700 million smartphone users and has experienced a significant upsurge in digital payment methods, now constituting over 99% of all transactions nationwide.

Central to this transformation is the government-supported Unified Payments Interface (UPI) system, which facilitated approximately 19.6 billion transactions totaling around ₹24.9 trillion (about $284 billion) just in September. Vehicle sales have risen correspondingly, with 4.73 million cars sold in 2024, increasing from 3.87 million the previous year—an uptick of 5.2% year-on-year and a new record.

Techcrunch event

San Francisco

|

October 27-29, 2025

Additional contributors to BlaBlaCar’s swift advancement in India encompass the nation’s insufficient public transport relative to its over 1.4 billion populace, along with the ongoing growth of road development enhancing links between minor towns, rural regions, and larger cities.

“We have numerous instances from users stating, ‘Previously, I would fly to a destination or take a train, or sometimes not travel at all—now, I can conveniently drive. It takes three hours, and it’s a delightful journey,’” shared Nicolas Brusson, co-founder and CEO of BlaBlaCar, in an interview.

BlaBlaCar first penetrated the Indian market in early 2015, establishing a local branch in New Delhi. The firm quickly encountered strong competition from Uber and local counterpart Ola, both of which were trialing carpooling options and extensively advertising them. (These companies ultimately suspended their carpool services during the COVID-19 lockdowns.)

Finding it challenging to establish a foothold, BlaBlaCar ceased its local operations in 2017. Nevertheless, the app remained operational—and by 2022, usage began to rise again. Since that point, it has soared from 4.3 million users in 2022 to a forecasted 20 million this year.

This year, BlaBlaCar has averaged approximately 1.1 million active users monthly in India, peaking at around 1.5 million in August. About 75% of these users are passengers, while the other 25% are drivers. Currently, India constitutes approximately 33% of the global carpooling users for BlaBlaCar, the company reported.

In terms of trips, BlaBlaCar achieved its healthiest growth in India, reporting 13.5 million trips completed as of September 30, an increase from 9.1 million during the same timeframe last year. Brazil remained slightly ahead, with 14 million trips this year compared to 11.7 million in 2023, while France held third place with 5.6 million trips, remaining relatively unchanged from the previous year.

“Our focus has shifted away from our initial markets in Western Europe toward regions like Japan, Turkey—and increasingly, India,” Brusson conveyed to TechCrunch.

Although BlaBlaCar does not currently generate income from India, drivers utilizing its platform earned around ₹713 million (approximately $8 million) just in August, as reported by the company. On average, drivers make about ₹390 (around $4) per seat in India, with the average trip distance being 180 kilometers (approximately 112 miles).

In contrast, average earnings for drivers are approximately €15 (around $17) in France and about €6.5 (around $7) in Brazil, despite comparable trip distances in India and Brazil, which are shorter than France’s average of roughly 250 kilometers (around 155 miles). BlaBlaCar noted that this discrepancy is attributed to lower local purchasing power and expectations for cost-sharing in India.

Almost 70% of BlaBlaCar’s users in India are aged between 18 and 34, and about 95% of interactions occur through its mobile application. Approximately half of the rides in India take place along the country’s 15 busiest intercity routes, with the other half coming from outside the top 150 corridors—indicating growing acceptance beyond major metropolitan areas and into smaller towns. Among the busiest routes include Pune–Thane and Pune–Nashik in Maharashtra, Bengaluru–Chittoor in Andhra Pradesh, and several other connections between mid-sized urban centers.

“No hurry” to initiate monetization

In spite of this growth, BlaBlaCar is not planning to introduce monetization in India in the near future.

“We are not rushing to start charging fees or earning revenue in India. Our focus is on increasing usage, and we have the experience from multiple markets to back that up,” Brusson stated to TechCrunch.

Nonetheless, BlaBlaCar intends to establish a local office in India with its first recruit expected by the end of this year or early the next, Brusson indicated.

BlaBlaCar does not see ride-hailing services like Uber and Ola as direct competitors within India. Brusson characterized them as “demand-driven” services, while he pointed out that BlaBlaCar is “supply-led.” The company believes that individuals using their own vehicles—or opting for easily accessible trains and buses—are its primary alternatives.

Obstacles on its path to success

BlaBlaCar continues to encounter several challenges in India.

State regulations regarding carpooling are unclear, which has led to the service being scrutinized in certain cities. Some users, including Jain, have voiced concerns over the difficulty in reaching BlaBlaCar’s customer support, which often relies on automated responses. The company informed TechCrunch that they maintain a “blended model,” with a local outsourced team managing most everyday inquiries and a smaller group at their Paris base overseeing intricate issues and quality assurance.

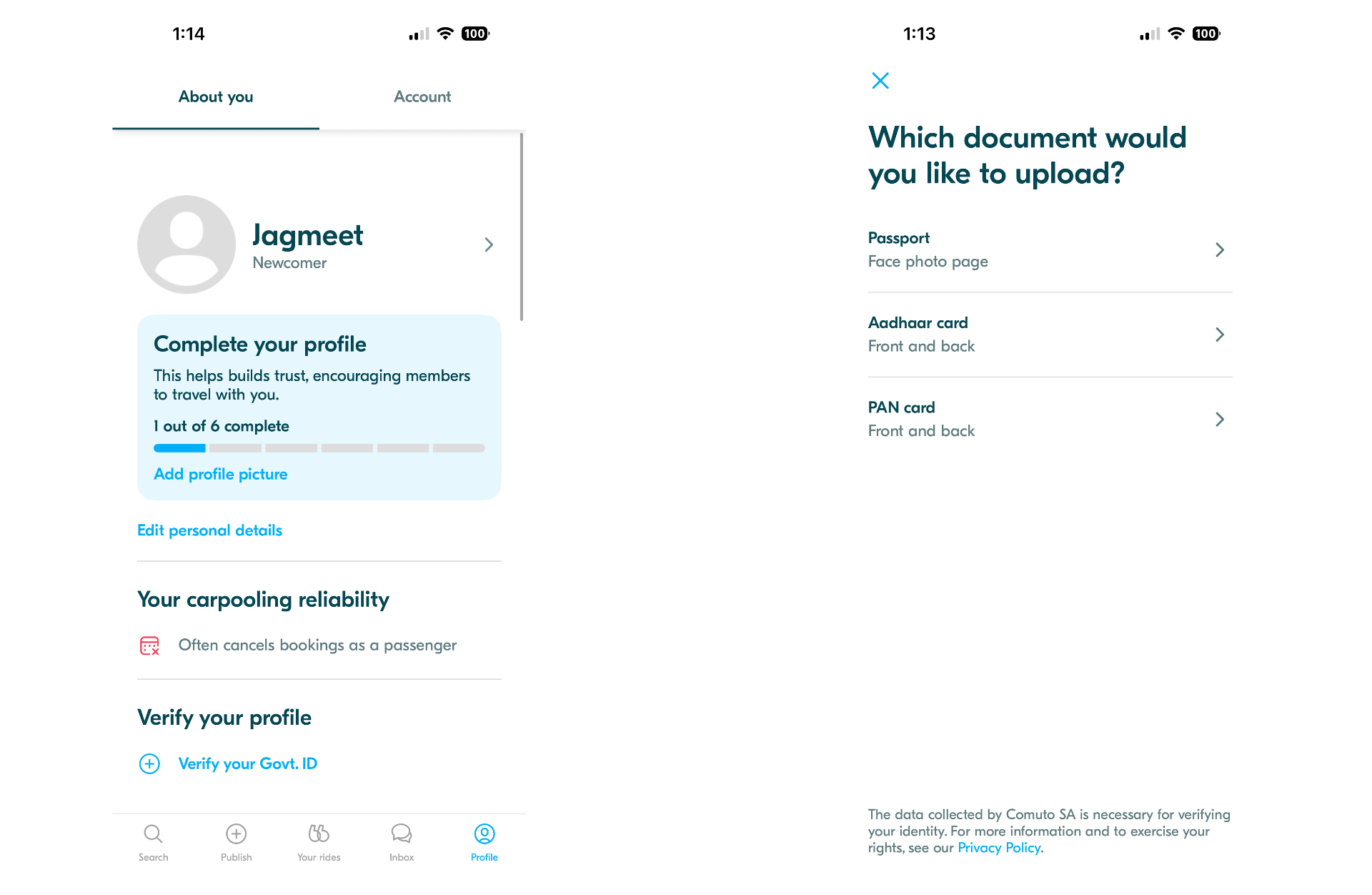

BlaBlaCar has launched an ID Check feature in India to authenticate users’ identities using government-supplied documents—a tool that has since been introduced globally. Nevertheless, TechCrunch discovered that users can still book or list a ride even if their ID verification is incomplete.

“This choice was intentionally made to facilitate engagement for new members on the platform,” the company responded. “ID verification is just one component of our extensive trust and safety strategy; we do not depend on a single feature, but rather on multiple, interconnected systems that collectively foster confidence within our community.”

The company emphasized that over 70% of rides in India are conducted by drivers who have undergone government ID verification. BlaBlaCar also showcases user reviews and ratings and authenticates accounts via phone numbers and email addresses.

“We strongly encourage members to finalize all verification processes, as profiles that are thoroughly verified—with photo and ID—greatly enhance the likelihood of securing carpool companions. Profiles that lack these elements tend to attract fewer bookings,” the company stated.

Some users of BlaBlaCar in India have also expressed dissatisfaction when drivers or riders cancel trips at the last moment, sometimes even after arriving at the meeting point. Furthermore, the app currently lacks a live location-sharing feature, which Jain pointed out limits its utility for those trying to arrange rides for family members or friends.

BlaBlaCar has modified its service offerings to better cater to Indian users, introducing features like “meeting-point logic” to facilitate coordination. Unlike countries such as France, where fixed carpooling zones are available, India does not have designated pickup spots. Drivers and riders typically agree to meet at convenient locations along the journey—like a petrol station or near a highway exit. The app now recommends and displays these sites using a combination of machine-learning algorithms and user feedback, assisting in minimizing detours and aligning with India’s existing infrastructure, as stated by the company.

Globally, BlaBlaCar anticipates accommodating approximately 150 million passengers this year, which includes users of its bus services operational in markets like France but not yet in India. As BlaBlaCar expands internationally, India’s unexpected growth has positioned it at the core of the company’s next phase of expansion.