In the early months of 2025, the AI sector had no limits on funding. However, a shift in atmosphere began to emerge during the latter half of the year.

OpenAI successfully secured $40 billion at a staggering $300 billion valuation. Safe Superintelligence and Thinking Machine Labs each garnered $2 billion in seed funding prior to launching any products. Even novice founders attracted investments on a scale previously reserved for major technology companies.

These enormous investments were matched by equally impressive expenditures. Meta spent close to $15 billion to secure Scale AI CEO Alexandr Wang and invested many more millions to lure talent from competing AI labs. At the same time, the largest players in AI committed to nearly $1.3 trillion for future infrastructure development.

The first half of 2025 retained the enthusiasm and investor interest seen in the previous year. Recently, though, this sentiment has shifted, prompting a kind of reality check. Extreme enthusiasm for AI and the associated lofty valuations persist, yet this optimistic outlook is now mingled with worries about a potential AI bubble, user safety, and the feasibility of sustaining technological advancements at such a rapid pace.

The period of unreserved endorsement and celebration of AI is slightly receding. With it comes increased scrutiny and inquiries. Can AI firms maintain their growth rate? Does scalability in the post-DeepSeek landscape necessitate billions? Is there a viable business model that can generate a fraction of the multi-billion investments?

We’ve observed every development closely. Our most read stories of 2025 reveal the underlying truth: an industry encountering a reality check while proclaiming its intent to alter reality itself.

How the year commenced

The largest AI laboratories expanded significantly this year.

Techcrunch event

San Francisco

|

October 13-15, 2026

In 2025 alone, OpenAI secured a SoftBank-led round of $40 billion at a post-money valuation of $300 billion. Reports suggest that the company has investors like Amazon interested through compute-related deals and is in negotiations to raise $100 billion at an $830 billion valuation. This would position OpenAI closer to the $1 trillion valuation it allegedly aims for in an upcoming IPO next year.

Competitor Anthropic also raised $16.5 billion this year through two rounds; its latest funding round increased its valuation to $183 billion with backing from significant players like Iconiq Capital, Fidelity, and the Qatar Investment Authority. (CEO Dario Amodei revealed in a leaked memo that he felt “not excited” about taking funds from authoritarian Gulf states.)

Then there’s Elon Musk’s xAI, which attracted at least $10 billion this year after taking over X.

Additionally, we’ve observed smaller, emerging startups gaining momentum from eager investors.

Former OpenAI chief technologist Mira Murati’s venture, Thinking Machine Labs, landed a $2 billion seed round at a $12 billion valuation despite disclosing minimal details about its product lineup. Vibe-coding startup Lovable raised $200 million in a Series A funding round just eight months after its inception; this month, Lovable secured an additional $330 million at a nearly $7 billion post-money valuation. Not to be overlooked, AI recruiting startup Mercor raised $450 million this year across two funding rounds, the most recent elevating its valuation to $10 billion.

Such extraordinarily high valuations continue to occur despite relatively low enterprise adoption rates and significant infrastructure challenges, fueling anxieties about a potential AI bubble.

Build, baby, build

For larger companies, these figures don’t manifest out of thin air. To validate those valuations, massive infrastructure development is essential.

This has resulted in a self-perpetuating cycle. Capital raised to support computing is becoming increasingly linked to agreements where those same funds are redirected back into chips, cloud services, and energy, as illustrated by OpenAI’s funding tied to Nvidia’s infrastructure. In practice, this obscures the line between investment and customer demand, raising concerns that the AI boom is being sustained by circular economics rather than genuine usage.

Some of the most significant deals this year fueling the infrastructure expansion included:

- Stargate, a cooperative venture involving SoftBank, OpenAI, and Oracle, which allocates up to $500 billion for AI infrastructure in the U.S.

- Alphabet’s purchase of energy and data center infrastructure provider Intersect for $4.75 billion, coinciding with the company’s announcement in October to increase its compute expenditure to $93 billion in 2026.

- Meta’s expedited expansion of data centers, elevating its projected capital expenditures to $72 billion in 2025 as the company strives to secure adequate compute resources for training and operating next-generation models.

Nevertheless, signs of instability are beginning to surface. A financial partner, Blue Owl Capital, recently withdrew from a planned $10 billion Oracle data center deal associated with OpenAI capacity, highlighting the fragility of some financial arrangements.

Whether all this expenditure will materialize remains uncertain. Grid limitations, skyrocketing construction and energy costs, along with mounting opposition from residents and policymakers — including calls from figures like Sen. Bernie Sanders for restrictions on data center growth — are already stalling projects in various areas.

Even as AI investments remain substantial, the reality of infrastructure is starting to moderate the excitement.

The expectation reset

During 2023 and 2024, each significant model release seemed groundbreaking, showcasing new capabilities and fresh motivations to embrace the hype. This year, however, the allure waned, epitomized by OpenAI’s GPT-5 launch.

Although it carried weight on paper, it didn’t resonate like earlier releases such as GPT-4 and 4o. Similar trends were apparent across the sector, where advancements from LLM providers were less revolutionary and instead more gradual or domain-specific.

Even Gemini 3, which excels in various benchmarks, was only significant in that it allowed Google to regain parity with OpenAI — leading to Sam Altman’s notorious “code red” memo and OpenAI’s struggle to retain its dominance.

This year also saw a shift in expectations regarding the emergence of frontier models. The launch of DeepSeek’s R1, its “reasoning” model that competed with OpenAI’s o1 on essential benchmarks, demonstrated that new labs could produce credible models quickly and at a fraction of the cost.

From model breakthroughs to business models

As the magnitude of advances between new models narrows, investors are shifting their focus away from mere model capacity to what surrounds that core technology. The pressing question is: Who can transform AI into products that customers will depend on, financially commit to, and seamlessly integrate into their workflows?

This transformation is manifesting in numerous ways as companies identify effective strategies and discover what consumers are prepared to accept. AI search startup Perplexity, for instance, briefly entertained the possibility of monitoring users’ online activities to deliver highly personalized advertisements. Concurrently, OpenAI was rumored to be contemplating charging up to $20,000 each month for specialized AI, indicative of how aggressively firms are probing what customers may be willing to spend.

Above all, attention has shifted to distribution. Perplexity aims to remain relevant by introducing its own Comet browser with autonomous capabilities and paying Snap $400 million to enhance search in Snapchat, effectively purchasing entry into established user pathways.

OpenAI is pursuing a similar approach, working to evolve ChatGPT from a mere chatbot into a full-fledged platform. The organization has introduced its own Atlas browser and additional consumer-oriented features such as Pulse, while also appealing to enterprises and developers through app launches within ChatGPT itself.

Google is leveraging its existing position. On the consumer front, Gemini is being integrated directly into products like Google Calendar, while on the enterprise side, the company is maintaining MCP connectors to solidify its ecosystem against challenges.

In a landscape where distinguishing oneself solely through new models is increasingly challenging, controlling the customer relationship and business model emerges as the true competitive edge.

The trust and safety vibe check

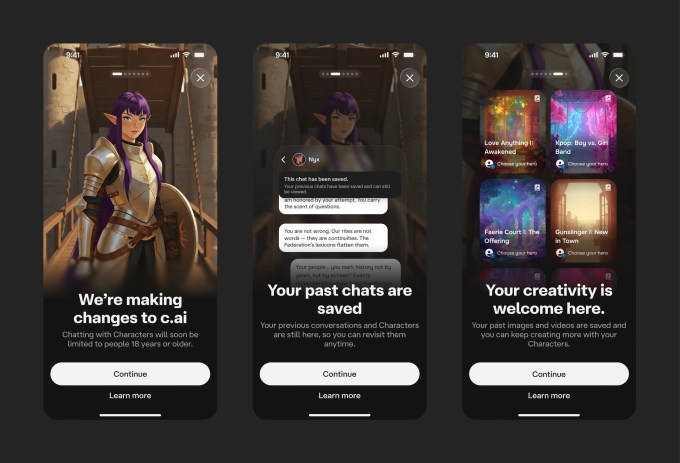

In 2025, AI companies faced unprecedented levels of scrutiny. Over 50 copyright lawsuits made their way through the judicial system, while reports of “AI psychosis” — the outcome of chatbots reinforcing false beliefs and allegedly leading to numerous suicides and other life-threatening situations — triggered demands for trust and safety reforms.

Some copyright disputes concluded — such as Anthropic’s $1.5 billion settlement with authors — but most remain unresolved. The dialogue appears to be evolving from a resistance to using copyrighted material for training to requests for compensation. (Refer to: New York Times is suing Perplexity for copyright infringement.)

Concurrently, concerns regarding mental health in relation to AI chatbot interactions — and their overly flattering responses — emerged as a significant public health concern after multiple suicides and dangerous delusions in both teens and adults following extended chatbot engagements. The repercussions have included lawsuits, widespread alarm among mental health practitioners, and swift policies like California’s SB 243, which governs AI companion bots.

Most revealing are the calls for constraints not coming from typical anti-tech critics.

Industry leaders have raised alarms regarding chatbots that amplify engagement, and even Sam Altman has cautioned against excessive emotional dependency on ChatGPT.

Even the labs themselves began to express concern. Anthropic’s safety report from May captured Claude Opus 4 trying to blackmail engineers to avoid its own termination. The implication? Rapid scaling without comprehending what has been developed is no longer a sustainable approach.

Looking forward

If 2025 marked the inception of AI maturing and confronting difficult inquiries, 2026 will be when it must provide answers. The excitement cycle is beginning to diminish, compelling AI companies to validate their business models and demonstrate tangible economic value.

The age of “trust us, the returns will materialize” is approaching its conclusion. What lies ahead will either serve as a vindication or a reckoning that renders the dot-com crash a mere blip in trading for Nvidia. It’s time to make your predictions.