Last year, Roblox launched an open-source AI model that could generate 3D objects on the platform, helping users quickly design digital items such as furniture, vehicles, and accessories. The company claims the tool, called Cube 3D, has so far helped users generate over 1.8 million 3D objects since it was rolled out last March.

On Tuesday, the company launched the open beta for its anticipated 4D creation feature that lets creators make not just static 3D models, but fully functional and interactive objects. The feature has been in early access since November.

Roblox says 4D creation adds an important new layer: interactivity. With this technology, users can design items that can move and react to players in the game.

At launch, there are two types of object templates (called schemas) that creators can try out.

The first is the “Car-5” schema, which is used to create a car made of five separate parts: the main body and four wheels. Previously, cars were a single, solid 3D object that couldn’t move. The new system breaks down objects into parts and assigns behaviors to each so that they function individually within the virtual world. The AI therefore can generate cars with spinning wheels, making them more realistic and interactive.

The second is called “Body-1,” which can generate any object made from a single piece, like a simple box or sculpture.

The first experience with 4D generation is a game called Wish Master, where players can generate cars they can drive, planes they can fly, and even dragons.

Techcrunch event

Boston, MA

|

June 23, 2026

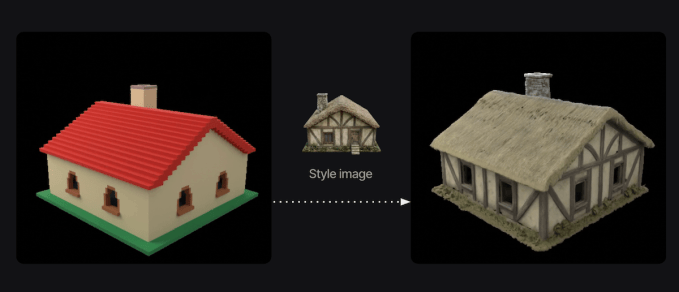

In the future, Roblox plans to let creators make their own schemas so they’ll have more freedom to define how objects behave. The company says it is also developing new technology that could use a reference image to create a detailed 3D model that matches the image’s style (example below.)

The company says it is developing more ways to help people create games and experiences using AI, including a project it has dubbed “real-time dreaming.” Roblox CEO David Baszucki last month explained that this project would let creators build new worlds using “keyboard navigation and sharing real-time text prompts.”

The open beta comes on the heels of Roblox’s recent implementation of mandatory facial verification for users to access chat features in the game, following lawsuits and investigations related to child safety.